New section

These resources can help you understand loan repayment options, determine a student loan repayment strategy, and manage your finances. Find additional FIRST resources, including videos, fact sheets, and articles on the Financial Aid page.

New section

New section

New section

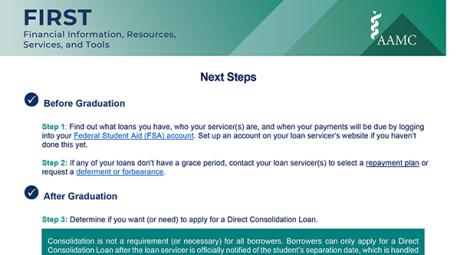

While you are looking forward to this next step in your medical career, you may also be experiencing mixed feelings of excitement and trepidation about the decisions that you must make in a short period of time. The following suggestions are provided to help you address important issues and to help you transition from medical school to residency.

- June 28, 2024

Do you want your medical education debt forgiven? Are you interested in learning about programs that might reduce your medical education student loans? Are you considering a career in public service or the military? There are numerous programs and opportunities available. Some of these programs are highlighted below and we encourage you to talk with the financial aid staff at your school to learn about other opportunities.

- December 3, 2024

If you borrowed federal student loans, loan repayment may be just around the corner — either after your 6-month grace period is over or after residency. Fortunately, you have options, so select the repayment plan that works best for you and meets your financial goals. When making this very important decision, always be sure to consult studentaid.gov to learn more about current repayment plans as they can and do change.

- November 17, 2025

During medical school, it’s likely your financial questions will revolve around student loans and money management. However, upon graduation, additional expertise may be needed to help manage the other areas of your financial life, like investments, retirement, insurance, taxes, estate planning, and more.

- November 25, 2024

Fourth-year medical students may encounter expenses not included in the standard student budget and may find it necessary to borrow additional funds through a residency and relocation loan. If you are considering a residency and relocation loan to cover some of your additional expenses associated with the residency match (traveling for interviews, related meals, lodging) or relocation costs, it’s important to understand how these private loans differ from federal loans.

- November 25, 2024

Disability insurance offers financial protection for future income if you experience a disabling sickness or injury. This may be particularly important for physicians who are unable to work in their chosen specialty.

- June 24, 2024