New section

Review strategies for managing your financial aid and daily finances while you’re in school, so that you can make the best financial decisions that will help you during and after medical school. Additional FIRST resources including videos, fact sheets, and articles can be found on the Financial Aid page.

New section

New section

New section

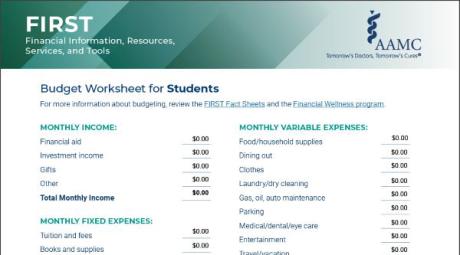

Money will probably be tight during medical school and residency. That’s why a realistic spending plan (budget) – one you can stick to – will be critical to your financial well-being.

The FIRST (Financial Information, Resources, Services, and Tools) program can help you make a smooth, successful, and informed transition to medical school. This is probably one of the biggest financial and personal investments of your life. Utilize the resources available to make wise and knowledgeable decisions about your future.

The biggest cost of the residency process will likely be the cost of interviewing. While these may be a minor part of the total cost of a medical education, it is still important to develop a strategy for managing these costs — before they are incurred.

- October 2, 2024

Many people choose to live with a roommate to make ends meet and save money. After all, what could be better than having someone pay half of your bills?

- November 25, 2024

Though the costs associated with applying for a residency position will be a minor portion of the total cost of your medical education, they can still add up. Because application fees are not always covered by student loans, it is important to develop a plan early on for how you will manage these expenses.

- June 7, 2024

Occasionally unforeseen emergencies occur that can affect your finances and your eligibility for financial aid. Under certain circumstances, financial aid administrators have the authority to adjust your financial aid eligibility. If you are experiencing a financial crisis, talk with your financial aid officer to see what options may be available.

- July 1, 2024