Guide to Public Service Loan Forgiveness (PSLF)

Guide to Public Service Loan Forgiveness (PSLF)

Introduction to Public Service Loan Forgiveness (PSLF)

If you borrowed money for undergraduate, graduate, or medical school through the federal Direct Loan program and are considering a career in public service, you may be eligible for the Public Service Loan Forgiveness (PSLF) program. Successful completion of this program can lead to forgiveness of federal student loan debt. This guide explains the PSLF program, eligibility requirements, and steps you will need to take to be eligible.

The guide is a resource provided by the AAMC Financial Information, Resources, Services, and Tools (FIRST) program. FIRST helps medical students and graduates make smart and informed financial decisions.

The information provided in this guide is accurate as of November 2023 and is subject to change. Please consult with your loan servicer to confirm the current details of the Public Service Loan Forgiveness program. The AAMC is providing this information as a public service and cannot guarantee your eligibility for this or any program. Please visit StudentAid.gov for current updates to the PSLF program.

Program Description

Program Description

What is Public Service Loan Forgiveness (PSLF)?

The Public Service Loan Forgiveness (PSLF) program is a federal program intended to encourage individuals to enter and continue to work in full-time public service positions. If you are thinking about working in a public service (which includes federal, state, local government, or not-for-profit organizations), the PSLF program is a great opportunity to provide service and, in return, qualify for loan forgiveness.

The program provides forgiveness for the remaining balance (principal and interest) on your eligible Direct Loans after you have worked for a qualifying public service employer and made 120 qualifying monthly payments while enrolled in a qualifying repayment plan.

PSLF Checklist

PSLF ChecklistChecklist for PSLF

- Have eligible Direct Loans.

- Enroll in a qualifying repayment plan and make qualifying payments.

- Work full-time for a qualifying eligible employer.

- Complete the borrower section of the PSLF form through the Federal Student Aid PSLF Help Tool. Do this annually and when you change employers.

- Ask your employer to complete the employer section of the PSLF form.

- Submit the PSLF form to the PSLF servicer. Your loans will transfer to the PSLF servicer if you have qualifying loans and are working for a qualifying employer.

- Keep a copy of the PSLF form for your records.

- Make 120 qualifying monthly payments. Keep records of the payments you make. Be sure the number of payments you make matches the number that the servicer indicates are qualifying payments. If there is a discrepancy, contact the servicer immediately.

- After making 120 qualifying payments, complete the PSLF form and apply for forgiveness. You must be working for a qualifying employer when you submit your form for forgiveness.

Resources

PSLF Employer Search Tool

PSLF Help Tool (Online PSLF Form)

PSLF Form (Paper Version)

PSLF Frequently Asked Questions

Eligibility Requirements

Eligibility Requirements

What are the Eligibility Requirements for PSLF?

A borrower must meet these requirements to be eligible for PSLF.

- Have Direct Loans in good standing.

- Be employed full time by a qualifying employer.

- Make 120 qualifying monthly payments.

- Be enrolled in a qualifying repayment plan.

Eligible Loans

Eligible Loans

Which Loans Qualify for PSLF?

Direct Loans in good standing:

- Direct Subsidized.

- Direct Unsubsidized.

- Direct PLUS Loans.

- Direct Consolidation Loans.

Other federal loans may be eligible if they are consolidated into a Direct Consolidation Loan (for example, Perkins Loans and Federal Family Education Loans (FFEL).

Eligible Employment

Eligible EmploymentWhat is Eligible Employment for PSLF?

To be eligible for PSLF, Direct Loan borrowers must work full time for an eligible employer. Eligible employers include:

- U.S.-based government (federal, state, local, or tribal), including U.S. military positions.

- Not-for-profit employer that is tax-exempt by the IRS and qualifies as a 501(c)(3).

- Certain not-for-profit employers providing qualifying public services.

- AmeriCorps and Peace Corps Volunteers.

Normally, you must be a direct employee of a qualifying employer; however, if you work in a state that has a law that prevents a qualifying employer from hiring employees directly to fill positions or provide services, an employee of a contractor organization could be an exception. This often occurs in states that have laws where health care facilities are not permitted to hire employees directly, so they contract with physicians’ groups. For more information about contractor positions, please visit the Federal Student Aid website.

Does Your Residency Program Qualify for PSLF?

Qualifying public service positions include work in 501(c)(3) nonprofit organizations, which may include medical schools and teaching hospitals. To verify if your residency program qualifies, check with your Human Resources Department. Many times, program directors are also familiar with PSLF and will be able to tell you if the residency program meets PSLF employer eligibility requirements.

Is Your Employer an Eligible PSLF Employer?

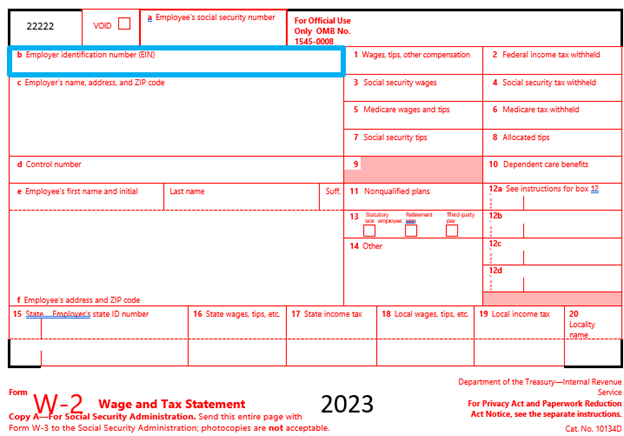

If you have your employer’s Employer Identification Number (EIN) and your employment dates, you can use the PSLF Employer Search Tool to determine if your employer is a qualifying PSLF employer. The EIN can be found on your W-2.

Qualifying Payments

Qualifying PaymentsWhat are Qualifying Monthly Payments?

- Payments made after October 1, 2007.

- On-time payments made while enrolled in a qualifying repayment plan. To make sure that you make on-time payments, it is suggested that you enroll in automatic debit with your loan servicer.

- Payments that cover the full amount due as shown on your bill.

- Payments also count when you are enrolled in one of the accepted types of deferments or forbearances.

- Qualifying payments do not need to be consecutive payments. For example, any time that you are not working for a qualifying employer, your payments will not count toward PSLF; however, they will count as a payment toward your loan balance.

- If you were enrolled in a repayment plan but not required to make a payment on your loan (like during COVID-19), payments still counted as qualifying payments for PSLF if you certified your employment during that time.

- For a limited time, some borrowers may be eligible for previous payment account adjustments.

PSLF Payment Tip: To maximize forgiveness under the PSLF program, you should repay your loans under one of the income-driven repayment plans that qualifies for PSLF. These repayment plans require smaller monthly payments, which means you’ll likely have a balance remaining (depending on the amount borrowed) after you’ve made your 120th payment.

Steps to Take for PSLF

Steps to Take for PSLFWhat Steps Should You Take to Qualify for PSLF Eligibility?

Step 1:

Verify that your loans are Direct Loans and qualify for PSLF. To view your federal student loans, log on to your FSA account at studentaid.gov.

Step 2: (Skip this step if your loans are all Direct Loans.)

If you have non-Direct Loans (FFEL or Perkins Loans) that you want to make eligible for PSLF, do the following:

- Apply to consolidate your FFEL/Perkins Loans by logging into your Federal Student Aid account at studentaid.gov.

- Select the loans you want to consolidate.

- Select MOHELA as your loan servicer and indicate that you are interested in PSLF.

Step 3:

When you begin employment with an eligible employer, complete the borrower section of the PSLF form and have your employer complete the employment section of the form. The PSLF form can be submitted electronically through the PSLF Help Tool, or by manually completing the paper form.

If MOHELA is not your current servicer, your loans will transfer to MOHELA for servicing once your PSLF form has been received and processed.

Step 4:

Apply for an income-driven repayment plan on the Federal Student Aid website or by contacting your federal loan servicer. Income-driven repayment plans are PSLF-eligible repayment plans. They also offer the lowest monthly payment when compared to other traditional repayment plans.

You can enroll in a repayment plan approximately 60 days prior to the end of your scheduled grace period.

If you want to “give up” your grace period and move into immediate repayment, you can apply for a Direct Consolidation Loan; however, you can’t apply for a Direct Consolidation Loan until your loan servicer has been officially notified by your school that you graduated/separated from school.

Step 5:

Annually, verify your income and household size information (as required for your income-driven repayment plan) and submit a PSLF form to verify your employment.

The PSLF servicer will verify the number of eligible payments you’ve made, and you will receive a letter verifying your PSLF payment count. Your PSLF payment count will only be updated when you submit another PSLF form that covers a new period of qualifying employment.

Once you’ve made 120 payments, the PSLF servicer will confirm your PSLF eligibility and forgive your remaining Direct Loan balance. You will want to continue to work for your qualifying employer and make payments until you receive notification that you officially made 120 qualifying payments.

You can verify your qualifying payment total by logging into your account with the PSLF servicer and by viewing your loan details. This information should also be found on your most recent billing statement.

Direct Loan balances forgiven through PSLF are non-taxable.